Renters Insurance in and around Orange

Your renters insurance search is over, Orange

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Home is home even if you are leasing it. And whether it's an apartment or a house, protection for your personal belongings is a good precaution, whether or not your landlord requires it.

Your renters insurance search is over, Orange

Coverage for what's yours, in your rented home

Renters Insurance You Can Count On

Many renters don't realize how much money they have tied up in their possessions. Your valuables in your rented space include a wide variety of things like your bed, microwave, favorite blanket, and more. That's why renters insurance can be such a good idea. But don't worry, State Farm agent Ben Suit has the personal attention and experience needed to help you choose the right policy and help you keep your belongings protected.

Call or email Ben Suit's office to learn more about the advantages of State Farm's renters insurance to help keep your belongings protected.

Have More Questions About Renters Insurance?

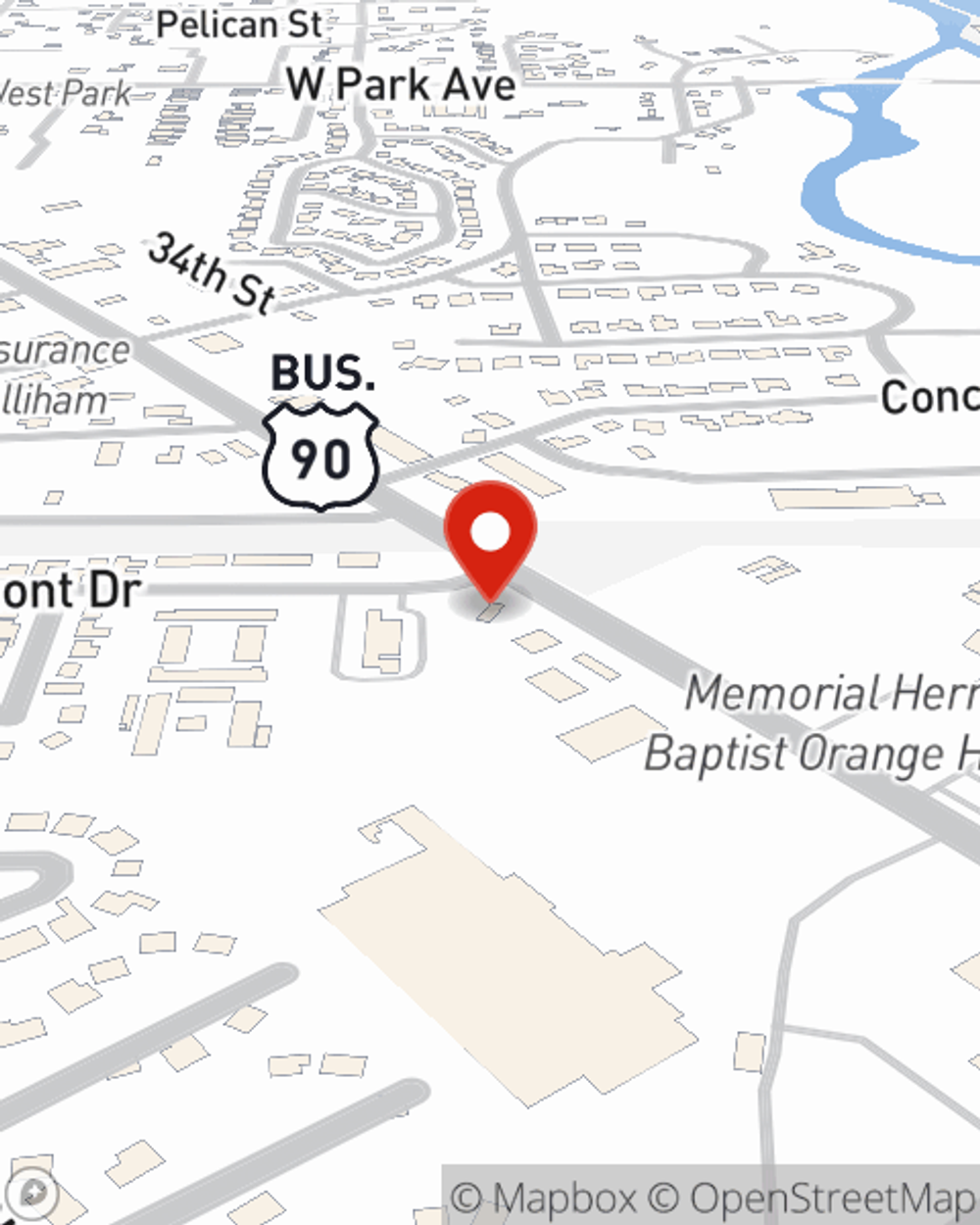

Call Ben at (409) 886-5218 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Does renters insurance cover hotel stay?

Does renters insurance cover hotel stay?

Renters insurance may offer support for hotel stays and temporary housing costs when your rented home becomes unhabitable due to a covered claim.